Cost of Doing Business Calculator

Fixed costs do not change when the output of goods or services changes, meaning these costs remain constant with an increase or decrease in the volume of output. Nor do they change over the life of a contract agreement or cost schedule. You’ll want your business operations to maximize business earnings, these depend on the amount of revenue generated and expenses incurred to operate the business. Think of them as the bills you have to pay even if you don’t make a single sale.

Risks of Cutting Operating Costs

Non-operating expenses appear below the operating expenses in your income statement. The very reason is to allow you to assess the core operations of your business. Thus, your company’s revenue is the first item that appears on the income statement. Then, you deduct COGS from revenue to determine your company’s gross income. However, non-operating expenses are the expenses incurred for reasons not related to the core operations of your business.

Operating Expenses (OpEx): Definition, Formula, and Example

A subset of indirect costs called selling, general, and administrative (SG&A) expenses takes care of costs related to running the business that aren’t directly tied to production. These include administrative salaries, marketing, and office management expenses. As with any financial metric, operating costs must be compared over multiple reporting periods to get a sense of any trend.

Operating cost — Electric vs gas dryer

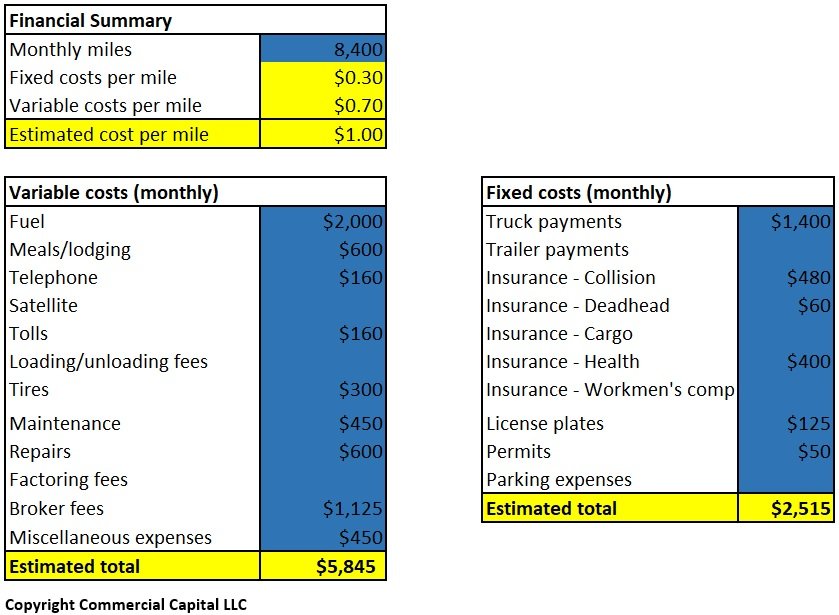

Operational costs include the cost of monthly payments, the cost of fuel to run the vehicle, the cost of depreciation, maintenance costs and the costs of insurance. Other costs, such as licensing and registration fees may be nominal, but still should be considered. Other charges, such as inspection charges, apply in some areas of the U.S. Consider all costs when figuring the costs of owning a particular vehicle. Now, the per-unit variable cost of production remains constant for a given level of output. But the per-unit variable costs increase as the volume of output increases.

Grant Gullekson is a CPA with over a decade of experience working with small owner/operated corporations, entrepreneurs, and tradespeople. He specializes in transitioning traditional bookkeeping into an efficient online platform that makes preparing financial statements and filing tax returns a breeze. In his freetime, you’ll find Grant hiking and sailing in beautiful British Columbia. For example, if you’ve invested $200,000 in plant and machinery, you’ll need to write off this capital expense over the useful life of the plant and machinery.

Operating Expenses Formula

Across the industry, on average automotive dealers make more money selling loans at inflated rates than they make from selling cars. Before you sign a loan agreement with a dealership you should contact a community credit union or bank and see how they compare. You can often save thousands of dollars by getting a quote from a trusted financial institution instead of going with the hard sell financing you will get at an auto dealership. This is to determine the ways in which you can reduce such expenses while still remaining competitive in the market. For this, you need to work out the costs of operating and owning the machinery. Directly reflects the health and efficiency of main business operations.

- Understanding operating costs helps you manage your business finances and make the most of your tax-deductible expenditures.

- Even if your budget does not allow for a hybrid or highly energy efficient car, a smaller, less powerful model will provide you with fuel savings.

- OOE takes into account three key factors — availability, quality and performance.

- Operating expenses include all of the above except the interest and tax expenses.

- Capital expenses, or CapEx, can include things like patents, machinery, and business real estate.

They have a fixed part you’ll pay regardless of your production levels. But there’s also a variable part that changes with your business activity or the size of your business. The operating cost is deducted from revenue to arrive at operating income and is reflected on a company’s income what if i didn’t receive a 1099 statement. Knowing how operating costs are depicted on each statement is essential for understanding a company’s financial performance and making informed business decisions. The third type of business costs are known as semi-variable and are similar to fixed and variable costs.

You should calculate each set of expenses to evaluate how well your business is doing financially. Some costs are not directly related to generating revenue, but others are. Ideally, you use your operating cost calculations to make changes and run your business more efficiently.

Generally, business operating costs are divided into two categories. On the other hand, operating expenses are the costs that you incur in normal business operations. Therefore, operating expenses do not form part of the Cost of Sales. This is because these are not directly linked to the production of goods or services.

For example, if you purchase a car that is four years old, you probably do not want a 60 month loan. This means that you will be paying car payments until the car is over nine years old. Even if your credit rating is less than stellar, you can still shop around for the best interest rate for your situation. This is because neither the total annual cost nor the total billable days per year can be negative.

This is because full coverage ensures that if the car is damaged or stolen, the lender will be able to recover the cost of their investment. For example, high end imports may cost three times as much as a standard domestic vehicle for a tune-up or oil change. When considering the cost of owning a vehicle, you must consider how often the car will need maintenance and how much the maintenance will cost. Fuel costs of operating an SUV are going to be much more substantial than for operating a smaller car. Even if your budget does not allow for a hybrid or highly energy efficient car, a smaller, less powerful model will provide you with fuel savings.